Easily accept and manage payments, increase business revenue, and offer the best payment experience to your customers.

Seamlessly add card payments to your website, mobile app, or platform using Flitt’s flexible SDKs and plugins.

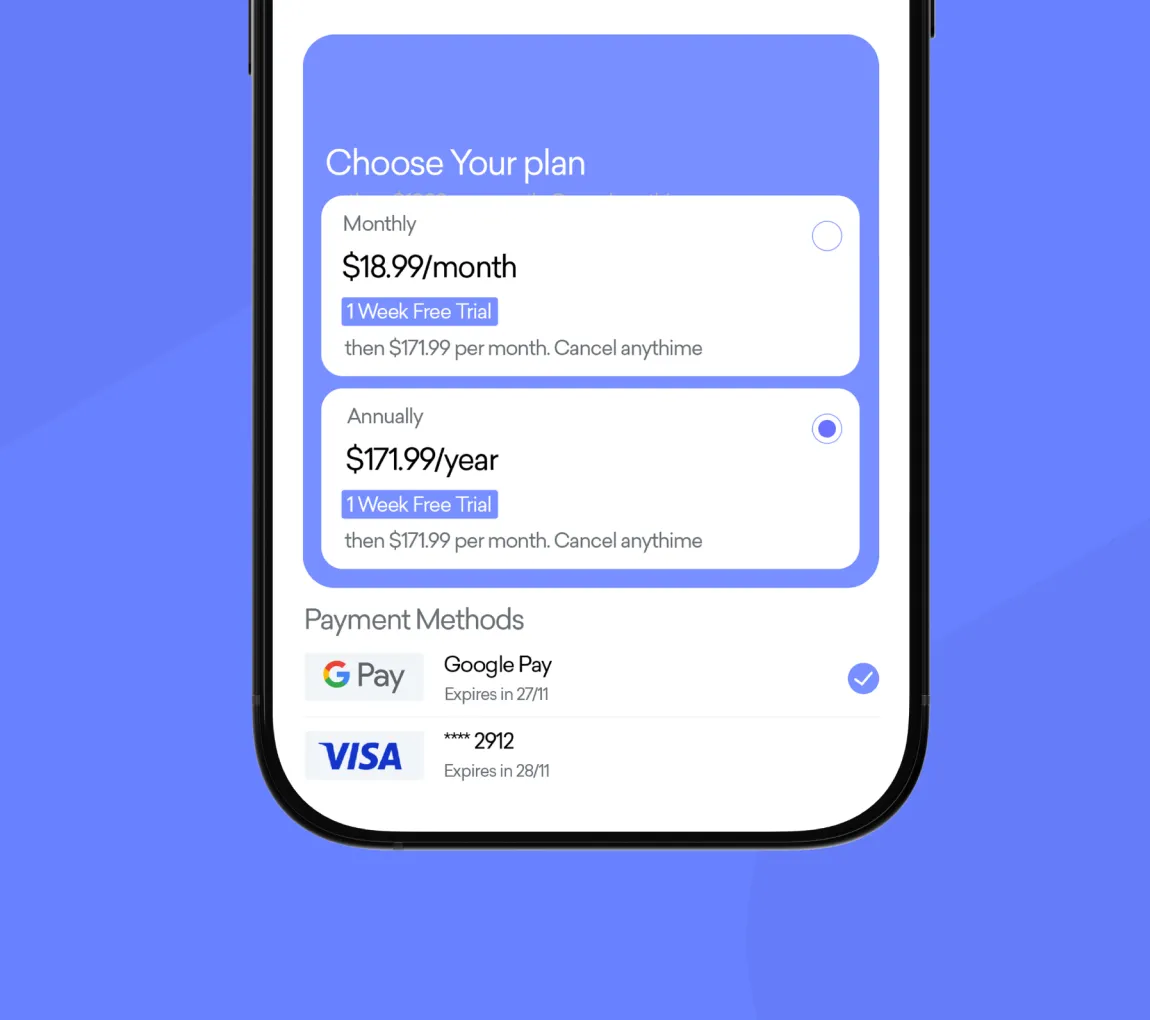

Choose between embedded or redirect flows, each designed to fit your brand and boost customer trust.

Real-time settlements, card saving, and clear insights, everything you need to grow efficiently and stay in control.

Flitt’s checkout solutions are built around business needs. Offering embedded or redirect flows that match your brand and deliver high conversion rates.

Card saving

Offer customers the ability to securely save their cards for faster repeat purchases, subscriptions, or one-click checkouts, on any device.

Everything you need to know about accepting card payments with Flitt.

What types of businesses do you serve?

Flitt’s platform serves online businesses of all sizes that are legally operating and officially registered in Georgia, Uzbekistan, Armenia, and Moldova.

What is required to start cooperation?

Complete online registration at: https://portal.flitt.com/#/account/create

What payment methods do you offer?

Card payments, Google Pay, Apple Pay, and bank account payments. TBC installment and split payments, as well as crypto payments, will be available soon.

On which e-commerce platforms can Flitt be integrated?

Shopify, WIX, WooCommerce, Tilda and more.

Is a website required to use Flitt?

A website is not mandatory. Payments can also be accepted via payment link.

Is a bank account required?

An active TBC bank account is required to use Flitt’s services.

Can Flitt be used alongside other payment providers?

Flitt can be seamlessly integrated alongside other payment systems.

What is the advantage of Open Banking?

Open Banking offers lower commission fees compared to other payment methods, with funds transferred directly to the merchant’s account.

Are Apple Pay and Google Pay available when using payment links?

All available payment methods, including Apple Pay and Google Pay, can be used when paying via link.

Which card types are supported?

Visa and Mastercard cards are supported.

When are payments settled to the account?

Payments are reflected within 24 hours.

If Flitt is integrated with Shopify, does Shopify still charge its transaction fee?

Shopify’s standard transaction fees continue to apply.

Can payments be received in USD and EUR?

Payments can be accepted in GEL, USD, and EUR.

How are refunds processed for foreign currency transactions when the product price was in GEL?

Refunds are processed at the same exchange rate used at the time of purchase. Any exchange rate difference is covered by the merchant.

How delete Flitt account?

To request deletion of your Flitt account, please contact us at support@flitt.com. Please use the subject line “Account Deletion” and include: the email address associated with your account and the reason for the request.

Account deletion requests are processed in accordance with applicable data protection laws.

Which bank's installment and BNPL services can Flitt integrate?

Currently in Georgia, Flitt offers integration for TBC Bank installments and BNPL, with Credo, Liberty, and BOG coming soon.

Other products

Card payment is one of the most in-demand methods in e-commerce. Flitt’s modern online payment system ensures stable payment processing, data protection, and uninterrupted transaction flow, which directly impacts customer trust and conversion rates.

When paying by card, security and speed are critical. Businesses achieve secure and uninterrupted online payments when the system complies with international standards and operates as a modern internet payment processing system.

Secure card data storage simplifies recurring transactions, allowing customers to save time and benefit from the best online payment experience.

Flitt’s card payment service is easy to integrate into both websites and mobile applications. With Flitt, payment page integration is flexible — you can embed the checkout directly on your website or use Flitt’s domain through redirection.

Flitt is a trusted online payment platform that brings together international payment systems, online banking payment services, and flexible payment methods in one unified environment. The platform ensures stable, seamless, and uninterrupted online payments, helping businesses operate more efficiently.

Products

Menu

Documentation

Follow us

Products

Menu

Documentation

Follow us